Table of Contents

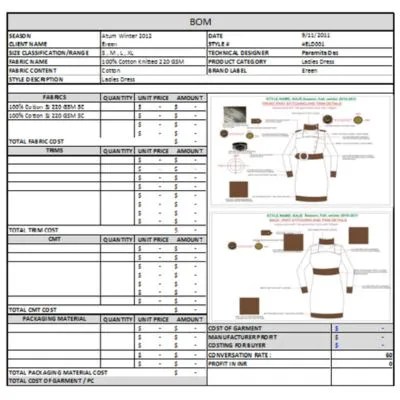

BOM Sheet

BOM refers to the Bill of Material (Raw material, unit price, total price). A bill of material is a structured list identifying all materials and components required to construct a product as well as instructions for producing and using the raw material.

Cost Sheet

Cost Sheet = Bill of Material + Manufacturing Cost + Others

BOM Sheet Vs Cost Sheet

A BOM is a list of materials involved in manufacturing, along with details of quantity, raw material, purchase type, basic dimension, supplier details, and other descriptions. Here cost of the each material is not mentioned. It is used for the apparel manufacturing process.

When the garments purchase department handles BOM they need to have the cost of each line item and overall assembly for financial planning and other use. It used an extra column of cost. Sometimes few more columns are based on batch quantity of material.

Differences between BOM Sheet and Cost Sheet in apparel manufacturing:

| Criteria | BOM Sheet | Cost Sheet |

|---|---|---|

| Definition | The cost Sheet is used for cost estimation, budgeting, and monitoring to ensure that the production remains within the allocated budget. It provides a comprehensive overview of all costs associated with production. | Cost Sheet is a document that provides a detailed breakdown of all the costs involved in the production of a specific garment, including materials, labor, overhead, and other expenses. |

| Objective | BOM cost helps in planning and tracking the required materials for production, ensuring that all necessary components are available before the apparel manufacturing process begins. | Cost Sheet is used for cost estimation, budgeting, and monitoring to ensure that the production remains within the allocated budget. It provides a comprehensive overview of all costs associated with production. |

| Content | Includes information on fabric, trims, accessories, and other raw materials necessary for garment production, along with their respective quantities. | Encompasses direct costs (materials, labor, and overhead) and indirect costs (administrative expenses, selling and distribution costs) associated with the production process. |

| Focus | Primarily focuses on the material aspect of production, providing a detailed breakdown of the components needed for manufacturing. | Encompasses a broader perspective, incorporating both direct and indirect costs associated with the entire production process. |

| Preparation Time | Typically prepared at the early stages of product development, during the planning phase. | Prepared before the production process begins, allowing for cost estimation and budgeting prior to actual manufacturing. |

| Usage | Used by production planners, sourcing teams, and inventory managers to ensure that the necessary materials are procured in a timely manner. | Used by management, finance departments, and production teams to analyze and control costs throughout the production lifecycle. |

| Updates | May undergo updates as design changes or material availability issues arise, ensuring accurate information for production planning. | May be updated periodically to reflect actual costs incurred during production and to make adjustments for future planning. |

| Example Information | Includes details like fabric type, color, quantity, trims, buttons, zippers, and other components needed for the garment. | Includes direct costs like fabric cost, labor cost, and overhead, as well as indirect costs like marketing expenses and administrative costs. |

Please note that the specific content and terminology used in BOM Sheet in garments and Cost Sheets may vary between different garment manufacturing industries.

Mahedi Hasan is a Textile Engineer, as well as a Top Rated content writer at Upwork, a Level 02 Seller at Fiverr, Level 02 Publisher at Ezoic. A passionate textile and fashion content writer, fashion SEO expert, and fashion web designer. Having a B.Sc. in Textile Engineering Degree from Textile Engineering College, Noakhali (TECN). The department is Apparel Engineering. Highly Experienced fashion writer for the last 3+ years. Have extensive 7 years of experience in the wholesale clothing business.